|

|  | Get Showtimes... |

Review #424 of 365

Movie Review of Maxed Out: Hard Times, Easy Credit and the Era of Predatory Lenders (2007) [NR] 90 minutes

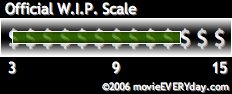

WIP™ Scale: $12.75

Where Viewed: Starz FilmCenter at the Tivoli, Denver, CO

When 1st Seen: 14 March 2007

Time: 8:00 p.m.

Film's Official Website

DVD Release Date: unscheduled![]()

Directed by: James D. Scurlock (Parents of the Year)

Written by: James D. Scurlock

Click for 'Review Lite' [a 150-word or less review of this film]

James D. Scurlock is not just out to make you mad, he's out to wake you up to the stark and sometimes startling reality of the gigantic fiscal problems and sometimes tragic consequences of living in debt. Overlapping the premise of both the national government as well as far too large a percentage of the population living and spending far beyond its/their means, Mr. Scurlock brings home the point that people follow the lead of their government. So much media time is spent covering the trade deficit figures, that people often forget the national debt. While related to each other, they are not the same thing. Being a debtor nation means that the USA actually owes more money to other nations than they owe to us. The perfect scenario would to either be even on this figure or to have others owing us more. The trade deficit means that we import more than we export in goods. Neither situation leads to a healthy national economy. Meanwhile, due to the practices of the banking industry, the film makes claims, that far too many people are living with debts on credit cards with high late fees, high interest rates, and continuing lines of unreasonably accessible credit such that they are overwhelmed and eventually will be burdened with this debt for the rest of their lives never quite able to pay the debt down. The convenience of the charge card which can be used nearly everywhere these days from vending machines to parking meters to fast food restaurants has promoted their use. Unfortunately, most people don't have any idea how much debt they are carrying until it is far too late. Recent changes in the bankruptcy laws have made it even more difficult for people who get overwhelmed to get a second chance out—legislation, by the way, the film claims was promoted by the banking industry and even written by the banking industry. Ironically, the banks claim they set the interest rates for people's credit cards based on risk, which often wouldn't exist in the first place if the rates were low enough for people to ever get ahead on the payments.

"…an important documentary that should be mandatory viewing for all college freshmen…"

The film, however, goes beyond the math and expert testimony from the likes of Elizabeth Warren, Harvard Law Professor and author of The Two income Trap and The Fragile Middle Class who fights diligently for consumer protection, and tells two particularly compelling stories of how enormous credit card debt had tragic consequences for these families. One family woke up to find their middle-aged mother had vanished with the car. Her last known purchase was $7 worth of gas for the car. She was not found. Upon looking for clues to her disappearance around her home, sadly they found credit card statements indicating she owed over $75,000 in credit card debt. Notices indicating other actions by the companies to reclaim the debt, apparently, sent her over the edge. Likewise, two mothers, both of whom had college-aged children who hung themselves when their credit card debts became insurmountable were also interviewed. These stories are compelling enough, but when another story of an Iraqi war veteran and the impact the war had on his family financially when his military pay was roughly half of what he had been making as a member of the local police force serve has sufficiently inflammatory material—enough, basically, to get anyone upset. One of the film's points is that using credit is addictive and gives people, especially those who can least afford it, the false sense of security that they really have a lot more money to spend than they do leading them to thousands and thousands of dollars of interest they may never be able to repay. Meanwhile, the cottage industries of debt collection and quick check loans have sprung up in response to the rise in debtors. The glee with which the debt collectors do their jobs, while exhibiting restraint and compassion for those from whom they hope to collect combined with the information that some of the nation's largest banks own or fund the quick check loan companies was almost too much to bear. Mr. Scurlock has made an important documentary that should be mandatory viewing for all college freshmen as well as anyone who intends to fill out any sort of credit application. Undoubtedly, there will be many people in the industry that find the film unfair or slanted against the banking industry, however, it's difficult to have sympathy for companies that are making billions of dollars per year off the money they lend when they have been accused of giving away credit to people that cannot afford it—like jobless college freshmen.

Back to Top | W.I.P. Scale™ | Most Recently Reviewed Films | Films of 2005 | Films of 2006 | Films of 2007

Click for 'Review Lite' [a 150-word review of this film]

Click for 'Review Lite' [a 150-word review of this film]

| Book | ||

| Same Author | Related Book | Related Book |

Maxed Out: Hard Times, Easy Credit and the Era of Predatory Lenders (2007) Review-lite [150-word cap]

James D. Scurlock is not just out to make you mad, he's out to wake you up to the stark, startling reality of the fiscal problems and sometimes tragic consequences of living in debt. Overlapping the premise of both the national government as well as far too large a percentage of the population living and spending far beyond its/their means, Mr. Scurlock brings home the point that people follow the lead of their government. Going beyond the math of the economics and expert testimony from the likes of Elizabeth Warren, Harvard Law Professor and author of The Two income Trap and The Fragile Middle Class, the film tells two compelling stories of how enormous credit card debt had tragic consequences for these families. Scurlock has made an important documentary that should be mandatory viewing for college freshmen as well as those intending to fill out any sort of credit application.

No comments:

Post a Comment